This is a case study of a European client who wished to purchase an active Airbnb property in Tulum, Mexico.

From start to finish, it took us 81 days to complete the process, which included property finding services, tax research, price negotiation, company setup, closing the transaction, and ultimately managing the process of transferring the Airbnb account and rental management.

1) Buying criteria

The first step was to schedule a call with the client to understand the type of properties he was interested in and identify any deal-breakers. We also established a fairly flexible budget, ranging from $500,000 to $2 million USD.

After an hour-long call, we documented the buying criteria and began our work. Our primary objective was to find a property with a minimum 8% cap rate located somewhere in Quintana Roo.

The buyer wanted immediate cash flow post-transaction, so we focused our search on established Airbnb businesses only.

*Minimum Price: $500,000

*Maximum Price: $2,000,000 (including closing costs)

*Cap Rate: 8% or higher (factoring in all costs and management fees)

2) Finding properties and tax research

Our next step was to exclusively use Airdna to identify suitable properties. In total, we found four properties that matched the client’s criteria, and all of them were located in Tulum.

We contacted the brokers responsible for selling the Airbnb properties to gather profit and expense information from the current owners. This data would later aid us in formulating a more suitable offer to achieve that 8% cap rate goal.

During our discussions with the brokers, we were presented with two additional private deals that aligned with our buyer’s criteria.

In total, we identified six properties.

With the assistance of our lawyers, we also conducted an in-depth tax research to understand the taxes, including their amounts, that the client would need to pay if he intended to operate a short-term rental business in Mexico.

3) Scheduling viewings

The next step was to schedule property viewings for the buyer. It took a total of two weeks of back-and-forth communication to find a suitable week for the viewings.

During this time, one out of the six properties was sold, but that posed no issue.

In the span of two days, the buyer physically inspected the properties. After returning home, he was prepared to make an offer on one of the properties he had visited.

4) Offer, negotiation and due diligence

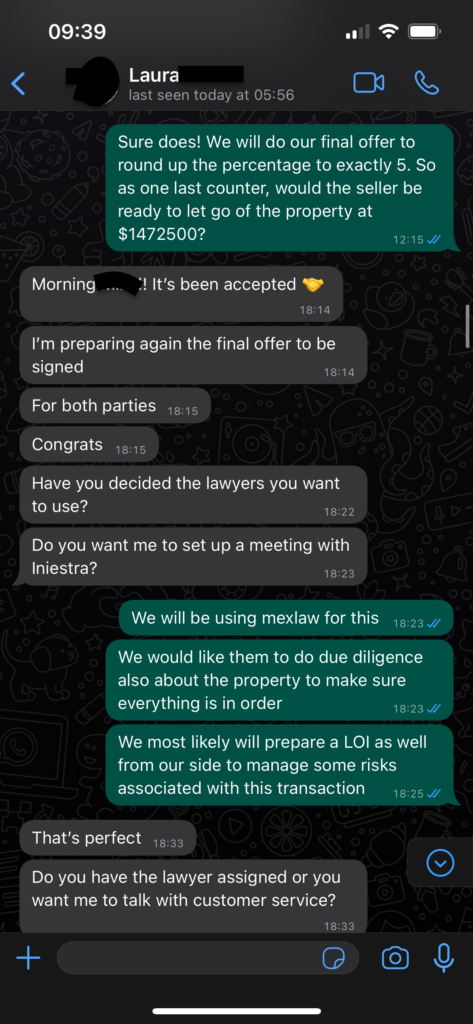

The negotiation process had its fair share of back and forth as we worked to reach a deal that felt right for everyone. Both sides started with different positions, leading to a series of offers and counteroffers—pretty standard in property deals like this.

Our goal was to look out for our client’s best interests while being mindful of what the seller wanted, taking the time to evaluate each proposal and respond strategically to find common ground.

In the end, after some thoughtful back-and-forth and a few adjustments, we managed to reach an agreement that satisfied both parties. The final outcome included a price reduction of about $175,000 from the initial asking price.

The details of the final agreement are outlined below:

A 10% deposit was needed to move forward with the transaction.

To protect the buyer, we opted for an escrow service.

After that, we started the due diligence. This included looking over profit and loss statements, getting a house inspection done by a third-party contractor in Tulum, and bringing in a local real estate lawyer to check that the title deed was clear.

5) Company and bank account creation

Since the offer was accepted, and the due diligence results were positive, we were one step closer to the final transaction.

However, because the buyer wanted to use his European company entity to purchase the property (for specific tax reasons), we had to establish a subsidiary company in Mexico that would be part of the EU company and handle the purchase in Mexico.

While we anticipated that this process might take longer, we managed to complete it in just 53 days, including setting up a bank account.

Keep in mind that if the buyer is foreign individual, incorporation is not needed – you will need bank trust services instead.

6) Converting EUR to MXN

We encountered another challenge when we had to convert Euros into Mexican pesos to finalize the deal. This proved to be a difficult task because the local EU banks did not offer a conversion service.

While a few banks did provide the service, their currency conversion fees were excessively high, amounting to around 4% of the transaction value. Fortunately, we eventually discovered a local bank in Mexico that was willing to perform the conversion at a more reasonable rate, so we opted for their services.

Looking ahead, we have identified alternative options such as Wise and other platforms that could potentially facilitate more cost-effective conversions from USD to MXN and EUR to MXN.

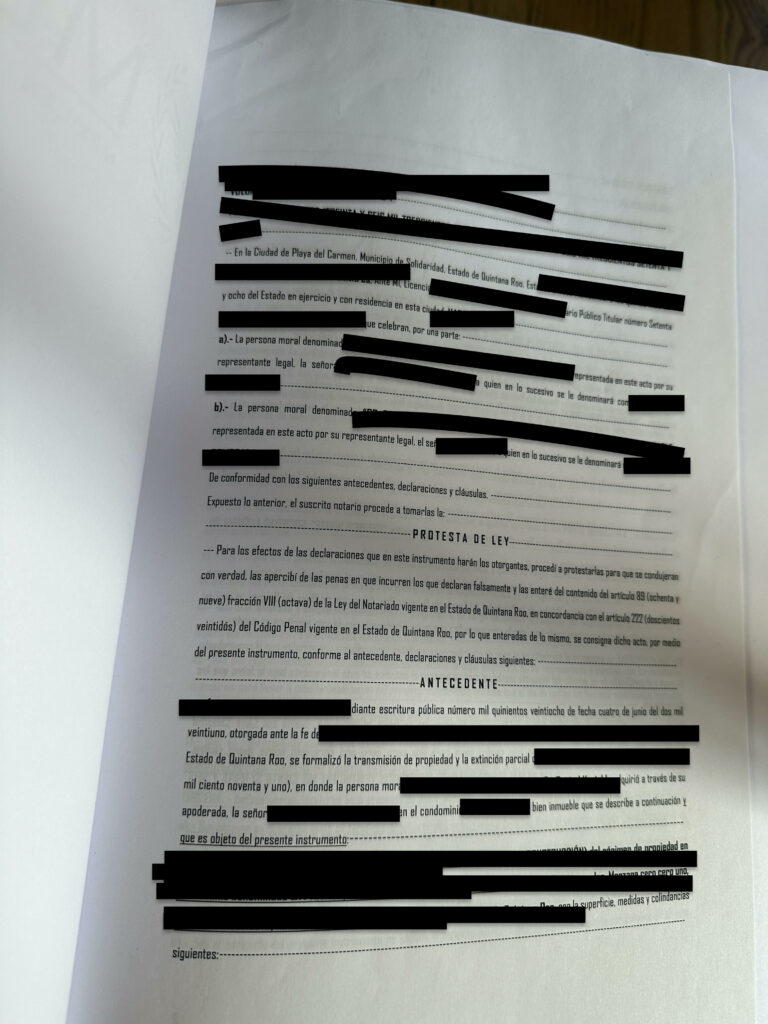

7) Closing the deal in Notary

The final step involved transferring the funds and completing the transaction at the Notary’s office.

When purchasing property in Quintana Roo, the Notary typically operates from either Playa del Carmen or Cancun.

Since the buyer couldn’t personally attend the closing, he enlisted the services of a local lawyer to act on his behalf with a Power of Attorney (POA). A few months later, the buyer traveled to Tulum to retrieve the title deed and Notary documents from the lawyer who had held them in the POA’s capacity.

Three months later, the owner was able to obtain a title deed, which guaranteed full ownership.

8) Rental management and monthly cashflow

To make the investment as hands-off as possible for the buyer, we arranged to keep the existing property manager, who had a strong track record with this property, boasting a 4.95+ rating from over 40 reviews. We negotiated a deal where the rental management would take care of everything—from utility payments and cleaning to general upkeep. They would also provide the owner with monthly profit and loss statements, with profits automatically deposited into his bank account.

We also hired an accountant to handle tax matters, manage dividend distributions, and ensure the company remains in good standing.

Although the buyer is far away, it’s reassuring for him to know there’s always a place waiting for him whenever the house is not booked.

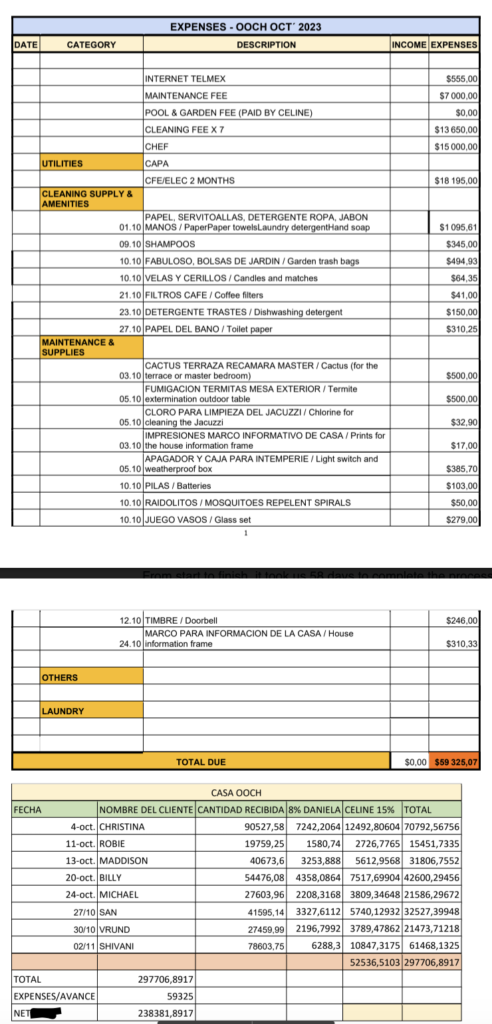

UPDATE: Last 12-month rental income numbers

The deal was completed in early August 2023, and since then, the new owner has generated over $200K in revenue, with $130K in pre-tax income after expenses. This translates to an 8.5% net cash-on-cash yield before taxes.

Below is the sample report for October.

Please note: All figures are in Mexican pesos.