Here is a story of a European client who reached out to us looking to invest in short-term rental properties in Latvia. We worked together for a total of 31 days, from the first conversation to the final handover.

Here’s how it all went down, step by step.

1) Setting buying criteria

We kicked things off with a call to really understand what the client was after—what kind of properties they liked, their non-negotiables, and the budget range they were comfortable with. We set a flexible budget of €150,000 to €300,000, knowing that there could be some wiggle room.

After the call, our team got straight to work, jotting down everything that mattered to the buyer. Our target was clear: find a property in Riga with a pre-tax cap rate of at least 7%. The property needed to generate income right away, so we zeroed in on established Airbnb rentals. It wasn’t just about finding a property; it was about finding the right business that would generate cash flow from day one.

- Minimum Price: €150,000

- Maximum Price: €300,000 (including closing costs)

- Cap Rate: 6% or higher, pre-tax (accounting for all expenses and management fees)

2) Property search and tax analysis

With the buying criteria in hand, we started searching. We used Airdna to analyze Airbnb data and identified two promising properties. One was in Riga’s Old Town, and the other was in the city center—both already operating as short-term rentals.

We reached out to the agents to gather detailed information about each property’s earnings and expenses directly from the owners. The numbers needed to make sense for that 7% cap rate we were aiming for. Meanwhile, our legal team in Riga dug deep into the local tax laws. They calculated exactly what the client would owe in taxes if they went ahead with a short-term rental business in Latvia, right down to the last euro.

3) Scheduling viewings

Next, we set up property viewings. This took some back-and-forth coordination to find a date that worked for the buyer and agents.

When the day finally arrived, the buyer dedicated a full day to see every property in person. There’s something you just can’t get from photos or numbers—a sense of the place, the vibe of the neighborhood, the feel of the building.

These on-site visits helped the buyer see beyond the data and start picturing what owning and running the property would actually be like.

4) Offer, negotiation and due diligence

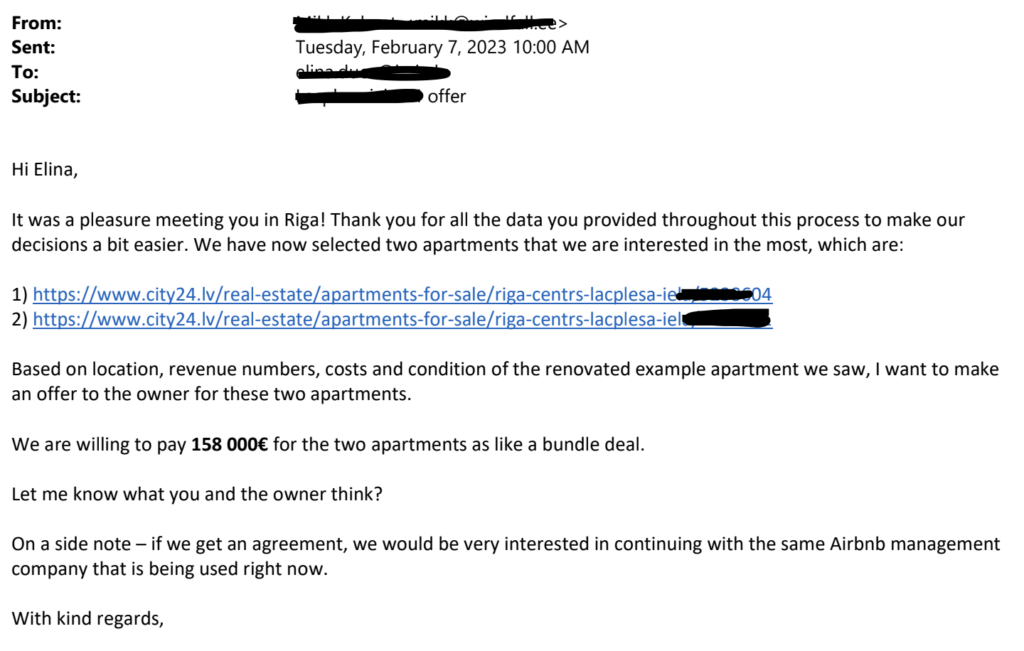

With two condos lined up—both owned by the same person—the buyer was ready to make an offer. The properties had good locations and seemed like they could bring in decent returns. The seller’s initial asking price was €172,000.

We saw some room to negotiate, so we got in touch with the seller. Since our buyer was prepared to move quickly, we used that as leverage to try and get a better deal. After about a week of back-and-forth, we settled on a final price of €158,000.

Once the offer was accepted, we put down a 5% deposit, which was held in escrow to keep things secure. Then we started the due diligence process: going through the properties’ financial records, looking at profit and loss statements, and hiring a professional appraiser to make sure the price was fair.

5) Buying process and Notary

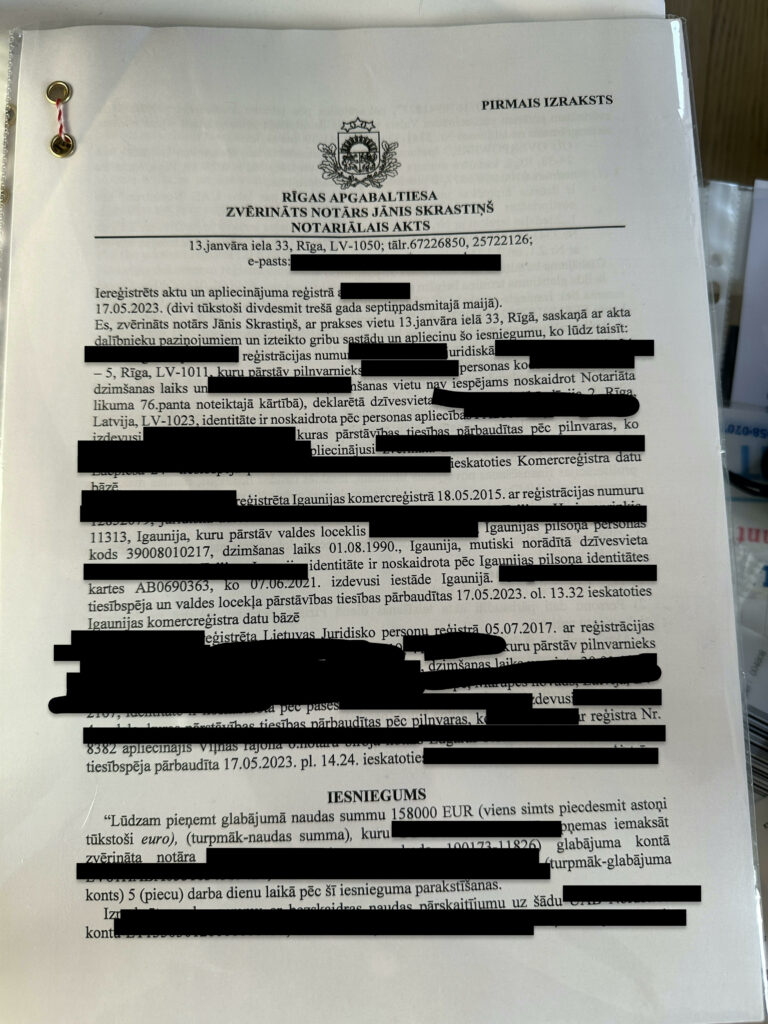

After everything checked out during due diligence, we moved forward with the purchase.

Since the buyer already had a company registered in Poland, they were able to use that for the purchase, which made things simpler. There was no need to set up a new company in Latvia.

We still had to show where the money was coming from, which took about five days for approval.

For anyone wondering, buying as an individual is also fine in Latvia—you don’t need to have a company.

The last step was to visit the notary in Riga to complete the sale. The buyer flew in for the day, signed the documents, transferred the funds, and that was it—the deal was done.

A month later, the buyer received the title deed, officially confirming ownership.

6) Rental management and monthly dividends

We kept the existing property manager on board due to their strong track record, with a perfect 5.00+ rating from over 70 reviews. Their experience with the property ensured a smooth transition and consistent service. The manager took care of all the day-to-day tasks, including cleaning, guest communications, check-ins and check-outs, and overall maintenance.

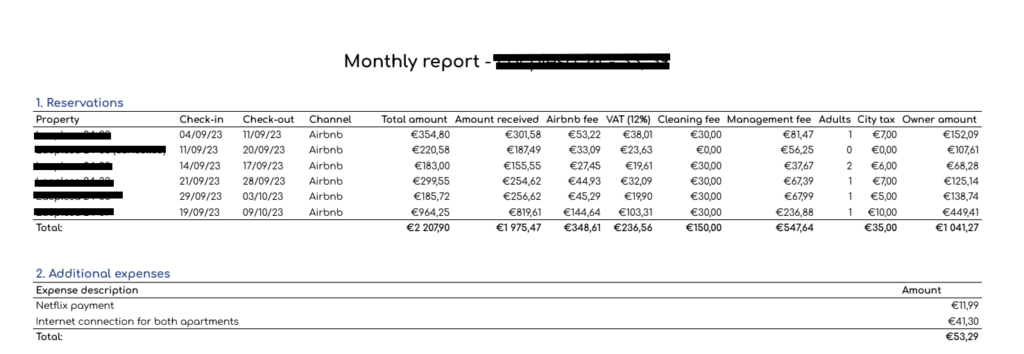

They also provided the buyer with detailed monthly financial reports, breaking down the income, expenses, and net profit.

While the management fee was set at 20% of the revenue, it proved to be worthwhile. It allowed the buyer to enjoy the benefits of rental income without getting involved in the day-to-day operations.

To ensure that the financial side of things was well taken care of, we also hired an accountant for €100 a month. The accountant handled tax filings, dividend distributions, and any other legal requirements related to the rental income. This arrangement gave the client peace of mind, knowing that all the paperwork and compliance aspects were being managed professionally.

Update: Last 12-Month Rental Income Numbers

Over the past year, the property has generated around €16,000 in total revenue, with a net profit of €9,600 after all expenses, giving a pre-tax NET yield of 6.11%. This return was achieved after accounting for the management fee, cleaning costs, maintenance, and other operating expenses.

Below is a sample of the monthly financial report, showing how the revenue and expenses were broken down, helping the buyer keep track of the property’s performance and cash flow throughout the year.